south carolina inheritance tax 2020

Your federal taxable income is the starting point in determining your state income tax liability. Does South Carolina Have an Inheritance Tax or Estate Tax.

Where S My Refund South Carolina H R Block

Unlike some other states there are no inheritance or estate taxes in South Carolina.

. Restaurants In Matthews Nc That Deliver. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The estate would pay 50000 5 in estate taxes.

South Carolina has no estate tax for decedents dying on or after January 1 2005. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket.

It is one of the 38 states that does not have either inheritance or estate tax. This threshold changes often but in 2020 the threshold was 1158 million. Property and Casualty Insurers Upload a copy of Schedule T and a copy of.

Individual income tax rates range from 0 to a top rate of 7 on taxable income. 2020 INSTRUCTIONS PROPERTY CASUALTY TAX RETURNS READ CAREFULLY IMPORTANT INFORMATION 1. If an inherited estate is valued above that amount then the excess money is taxed.

Federal exemption for deaths on or after January 1 2023. In case you inherit a property from a resident of another state you will have to pay that states local inheritance tax. You would receive 950000.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Manage Your South Carolina Tax Accounts Online. Securely file pay and register most South Carolina taxes using the SCDORs free online.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the. The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand. If an estate is valued over a certain amount 1158 million in 2020 the estate is subject to an estate tax.

Restaurants In Erie County Lawsuit. Ad From Fisher Investments 40 years managing money and helping thousands of families. Large estates that exceed a lifetime exemption of 1206 million are subject to the federal estate tax.

In 2020 rates started. State Inheritance Taxes. Heres how estate and inheritance taxes would work.

Check the status of your South Carolina tax refund. You would pay 95000 10 in. The federal estate tax is levied on a propertys taxable part.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Contrary to what many people think federal estate taxes do not apply. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020.

A 1 million estate in a state with a 500000 exemption would be taxed on 500000. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. We invite you to come in and talk with one of.

Opry Mills Breakfast Restaurants. For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax exemption is 5340000 he would have 4340000. South Carolina Inheritance Tax 2021.

South Carolina Estate Tax 2020. 1 Decedent means a deceased person. The estate tax is paid by the estate whereas the inheritance tax is levied on and.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

A Guide To South Carolina Inheritance Laws

South Carolina Tax Resolution Options For Back Taxes Owed

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

Real Estate Property Tax Data Charleston County Economic Development

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

A Guide To South Carolina Inheritance Laws

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

South Carolina Estate Tax Everything You Need To Know Smartasset

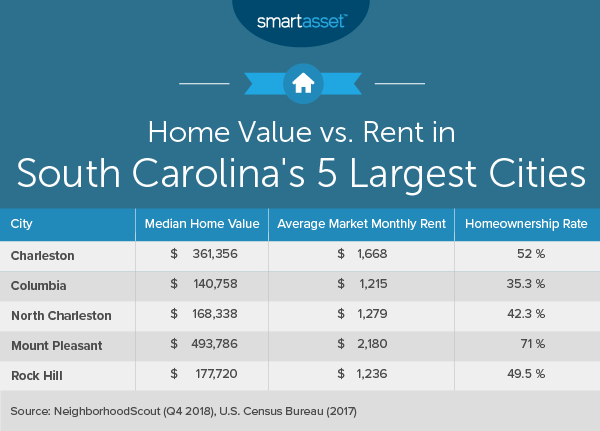

Cost Of Living In South Carolina Smartasset

A Guide To South Carolina Inheritance Laws

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

States With No Estate Tax Or Inheritance Tax Plan Where You Die