oregon tax payment extension

Your browser appears to have cookies disabled. An extension to file your return is not an extension of time to pay your taxes.

Applications for alternative filing method for temporary employers.

. The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until October 15 2020. Avoid penalty and interest make your extension payment by April 15 2021. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time.

Federal automatic extension federal Form 4868. When paying estimated tax or extension payment you arent required to file a coupon or the Oregon-only extension form. Oregon uses Form 40-V the payment voucher to file an extension request with payment - just check the extension payment checkbox to apply for an automatic six-month extension of time to file your Oregon return.

For personal income taxpayers. You can make a state extension payment using Oregon Form 20-V Oregon Corporation Tax Payment Voucher. Whether you owe Oregon tax for 2021 or not mark the.

Enter your Oregon Business Identification Number BIN or Account ID enter all numbers including zeros and Four-Digit. Extension payments can also be made online via Oregons Electronic Payment Services. Estimated tax payments for tax year 2020 are not extended.

Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs. Simple Step-By-Step Instructions Make It Easy To File Taxes Early Or File An Extension. Salem OR 97309-0920.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. You can make a state extension payment using Oregon Form 40-EXT or you can pay online via Oregons Electronic Payment Services. Whether you owe Oregon tax for 2020 or not mark the Extension filed check-box whether you had an Oregon or federal extension when you file your Oregon return.

File this form to request an extension. The 2022 interest rate is 5. We last updated the Payment Voucher for Income Tax in January 2022 so this is the latest version of Form 40-V fully updated for tax year 2021.

An extension of time to file your return is not an extension of time to pay your tax. File your Oregon return use the tax payment worksheet on the next page to calculate your extension payment and fol-low the payment instructions under Payment options To avoid penalty and interest make your extension payment by April 18 2022. Use the Payment History button to cancel Pending payments or view Pending Processed and Canceled EFT payments.

The 4th month following the tax year end. The service provider will tell you the amount of the fee during the transaction. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

Mail your Personal Income Tax Voucher s with your payment s to. Payment is coordinated through your financial institution and they may charge a fee for this service. To request an extension for time to file you must.

You dont need to request an Oregon extension unless you owe a payment of Oregon tax. Complete the tax payment worksheet below to determine if you owe CAT for 2021. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

Once your transaction is processed youll receive a confirmation number. Cookies are required to use this site. The Oregon return filing due date for tax year 2019 is automatically extended from April 15 2020 to.

The Oregon Department of Revenue announced it is joining the IRS and automatically extending the tax year 2020 filing due date for individuals from April 15 2021 to. To Oct 15 for calendar years The due date is the 15th day of. Submit your payment electronically by selecting Return payment on Revenue Online.

Annual withholding tax reconciliation reports Form WR with payment or deposit. Your Oregon corporation tax must be fully paid by the original due date April 15 or else penalties will apply. Checks and payment vouchers for multiple tax programs can be mailed in the same envelope.

When filing an Oregon tax return for 2020 include your exten-. Mail a check or money order. Include payment of the estimated tax due along with this extension request.

To avoid interest and penalties your Oregon tax liability must be fully paid by the original deadline. Keep this number as proof of payment. Use this payment voucher to file any payments that you need to make with your Oregon income taxes.

A tax extension gives you more time to file but not more time to pay. Oregon Extension Payment Requirement. If you owe taxes you must pay at least 90 of your total tax liability by April 15 2022 to avoid penalties and interest.

Please login with your Business Identification NumberAccount ID and PIN to view the Company ID for the Oregon Department of Revenue. Your Oregon income tax must be fully paid by the original due date April 15 or else penalties will apply. Its important to note that a tax extension only gives you more time to file not to pay.

Cigarette tax stamp orders. Combined Payroll and Withholding. An extension of time to file is not an extension of time to pay.

If you need an extension of time to file and expect to owe Oregon tax download Publication OR-40-EXT from our forms and publications page for instructions. Oregon will honor all federal extensions of time to file individual income tax returns as valid Oregon extensions. You can make an Oregon extension payment with Form 20-V or pay electronically through Oregons Electronic Services center.

An extension of time to file your return isnt an extension of time to pay your CAT. You must be registered for Oregon Corporate Activity tax CAT prior to submitting this form. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Revenue Division - Personal Income Taxes. Get Your Max Refund Today. If you dont pay all the CAT due by the 15th day of the fourth month following the.

Or to make an extension payment by mail download. Find out if you owe using Oregons How much do I owe website. If you owe Oregon personal income tax follow the instructions on Publication OR-EXT to.

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Nut Growers Handbook Oregon Hazelnut Industry Growers Hazelnut Homestead Farm

Irs Tax Extension To Jan 15 For California Wildfire Victims California Wildfires Prayers Coast Guard Boats

Super Fast Travel Using Outer Space Could Be 20 Billion Market Disrupting Airlines Ubs Predicts Space Travel Space Tourism Tourism Marketing

Loan Agreement Template Sample Loan Loan Money Agreement

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Free Customizable Real Estate Contract Template Templateral Real Estate Contract Wholesale Real Estate Real Estate Forms

State Of Oregon Oregon Department Of Revenue Payments

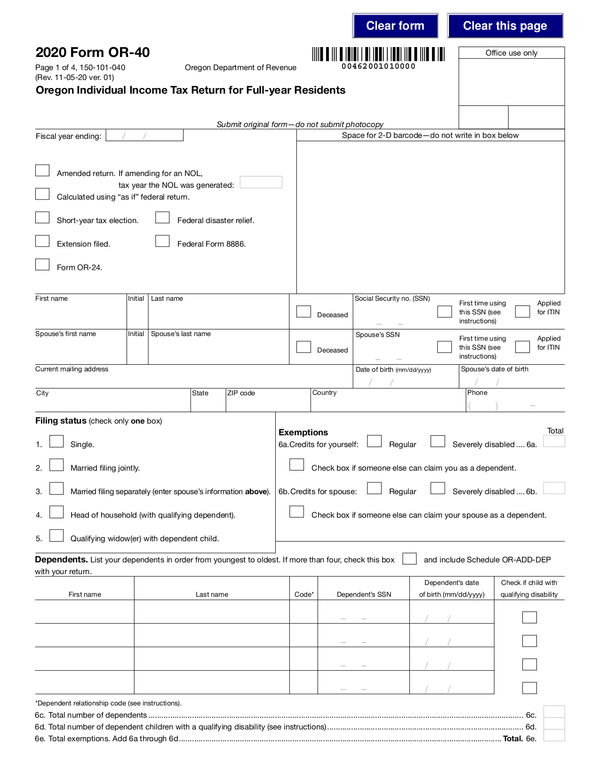

Fill Free Fillable Forms For The State Of Oregon

Classroom Guide To Fire Safety By The Oregon State Fire Marshal Fire Safety Classroom Classroom Projects

You Can Now Calculate Your Share Of Oregon S 1 9 Billion Kicker Tax Credit Coming Next Year Ktvz

Fill Free Fillable Forms For The State Of Oregon

Pin By Monica O Connor On Hooking Book Folding Patterns Free Sewing Patterns Free Bag Book Folding Patterns