student loan debt relief tax credit for tax year 2020

From July 1 2022 through September 15 2022. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

7 Personal Loan Companies To Have On Your Radar For Debt Consolidation Debt Relief Programs Debt Relief Loan Company

410 767-3300 or 800 974-0203.

. To qualify you must be enrolled for at least one academic period at least half-time each year. EXECUTIVE SUMMARY. The student loan interest deduction is reportable on Form 1040 in the AGI adjusted gross income category.

It includes both required and voluntarily pre-paid interest payments. Your household earnings are 68000 the approximate median in the US which means you fall within the 22 tax bracket. The credit covers 100 of the first 2000 in qualified expenses plus 25 of the next 2000.

CCI or American Career. 127 c 1s definition of educational. The student loan interest deduction is reportable on Form 1040 in the AGI adjusted gross income category.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Ad Try Our Free PSLF Tool To See Your Options and Eligibility For Student Loan Forgiveness. Collection activities are currently paused through Nov.

You may deduct the. Were eligible for in-state tuition. Under Maryland law the recipient must submit proof of payment to MHEC showing that the tax credit was used for the purpose of paying down the qualifying student loan debt.

The relief is retroactive to Mar. Student loan interest is interest you paid during the year on a qualified student loan. If you paid 600.

Specifically the act amends Sec. Relief is also extended to any creditor. How to Claim the Credit.

The rule is that you get to deduct the lesser of 2500 or the amount of interest you actually paid. A copy of your Maryland income tax return for the most recent prior tax year. 116-136 and a presidential order government-held federal student loans are in administrative forbearance through the end of 2020 meaning.

Submitted an application to the MHEC by September 15 2019. Complete the Student Loan Debt Relief Tax Credit application. WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school.

Like any other year when you file your taxes you can deduct the interest you paid on your qualified student loans in 2020 up to a certain amount according to the IRS website. If you pay 35 in taxes and you have 10000 of debt forgiven then youd owe 3500. Loan servicers make reporting this amount on your taxes easy.

1 day agoFor 25 months student loan repayment on most federal student loans has been suspended and interest has been frozen as well. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. The Student Loan Debt Relief Tax Credit is a program created under 10.

Complete the Student Loan Debt Relief Tax Credit application. See If You Qualify For Loan Forgiveness Under The Public Service Loan Forgiveness Program. When you pay taxes on 2022 income the forgiven debt would be taxed at 22.

Student Loan Debt Relief Tax Credit for Tax Year 2021. Can You Get a Refund for Private Student Loan Payments. 127 can also be used in 2020 for student loan repayment.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university. The IRS announced an expansion of relief to additional individuals who borrowed funds to attend school and later had that debt cancelled in Revenue Procedure 2020-11. File Maryland State Income Taxes for the 2019 year.

If you pay 25 in taxes and you have 10000 of debt forgiven then youd owe 2500. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. Theyre required to send you a Form 1098-E stating how much you paid in interest.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. In fact the 2500 deduction can be utilized by holders of both Federal and Private student loan debt as. 6 North Liberty Street.

Deductions reduce your taxable income while tax credits reduce the amount you owe in taxes. For more information contact. The COVID-19 pandemic has renewed focus on the student loan debt crisis.

For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate. It requires a completely separate form attached to a Form 1040 tax return and receipt of a Form 1098-T from the institution where the student was enrolled.

What that means is if you only paid 500 in interest then youll only be able to deduct 500 from your return. Have at least 5000 in outstanding student loan debt upon applying for the tax credit. If you owed 1000 in taxes and receive a 500 credit youd subtract the credit from your taxes due.

The deduction is gradually reduced and eventually eliminated by phaseout when your modified. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. 1 The IRS had previously granted relief to those who attended schools owned by Corinthian College Inc.

Thats a maximum annual tax credit of 2500. However if you paid 5000 in interest youll still only be able to claim that maximum cap of 2500. Incurred at least 20000 in total student loan debt.

The 5250 that employees are permitted to receive tax-free for their education under Sec. Maryland Higher Education Commission. STUDENT LOAN DEBT RELIEF TAX CREDIT.

Your new tax bill would be 1000 taxes due 500 credit 500. IR-2020-11 January 15 2020. 13 2020 meaning any tax refunds seizes or wages garnished during the past year will be returned to the borrowers.

Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. The student loan tax deduction for paid interest is limited to 2500 and its also. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

In response to the pandemic under a provision in the Coronavirus Aid Relief and Economic Security CARES Act PL. Lets Look at an Example. The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Your savings is 500. The funds must be applied to the employees own student debt not the debt of the employees spouse or dependents.

To qualify for the Student Loan Debt Relief Tax Credit you must. The Department of Education. Ad We Specialize in Student Loan Forgiveness Programs.

As I stated above youll end up being taxed on your forgiveness benefit based on the income tax bracket that you fall under. Maryland taxpayers who have incurred at least 20000 in undergraduate andor. 1 2022 for all federal student loans and commercially held FFEL debt which could protect your 2021 refunds.

Tax Debt What To Do If You Owe Back Taxes To The Irs Tax Debt Debt Irs Taxes

Student Loan Forgiveness Changes Who Qualifies And How To Apply Under Biden S Expansion Of Relief

Tax Relief Debt Relief Programs Debt Relief Tax Relief Help

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Are The Pros And Cons Of Student Loan Forgiveness

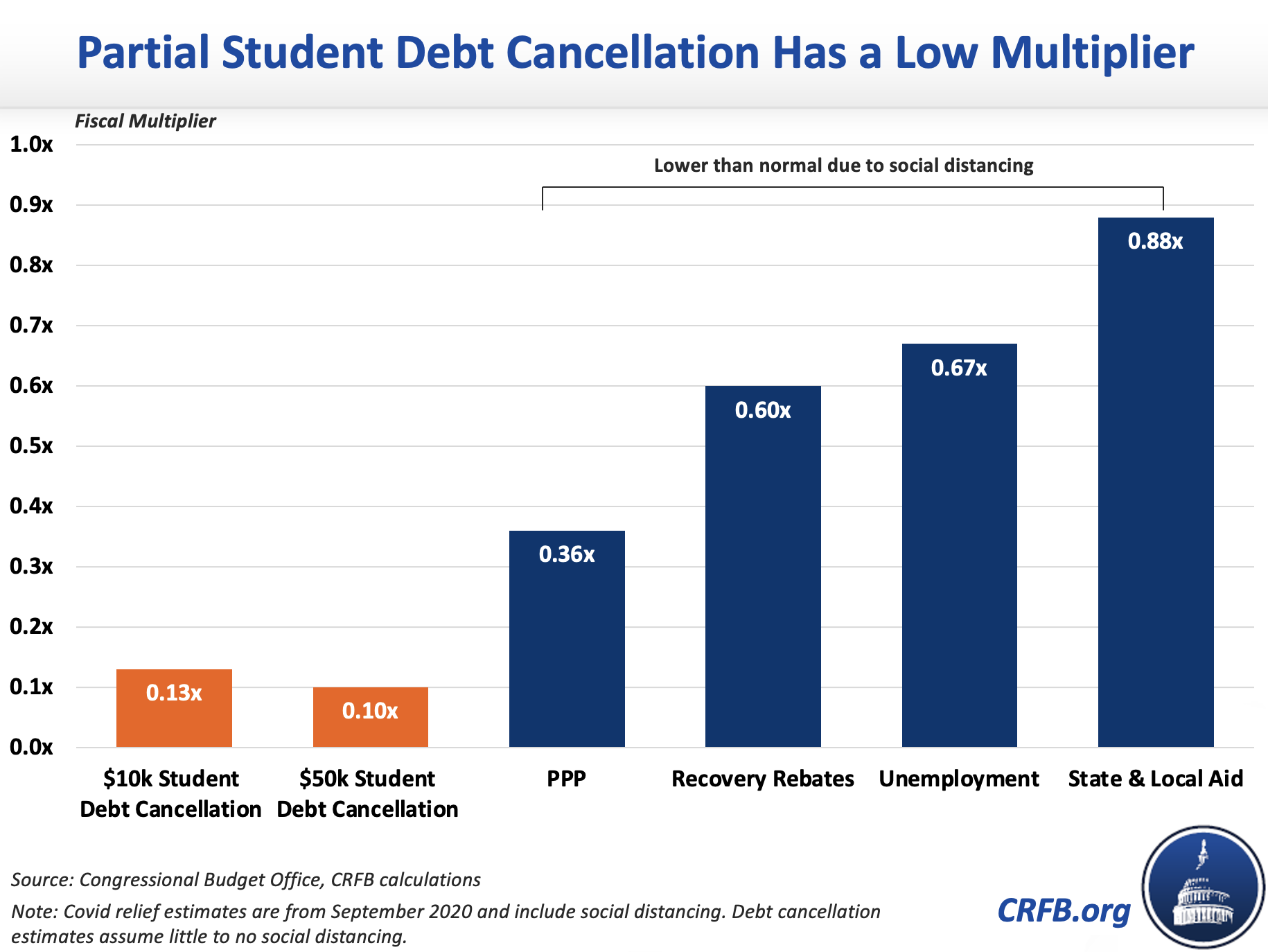

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

The Best Order Of Operations For You To Pay For College Saving For College College Finance Order Of Operations

Liberty Tax Service Bookkeeping Tax Services Colorado Springs 481 Hwy 105w Suite 201 Monument Debt Relief Programs Credit Card Debt Relief Budgeting Money

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Are The Pros And Cons Of Student Loan Forgiveness

Best Personal Loans Of March 2022 Nerdwallet Debt Relief Programs Best Payday Loans Personal Loans

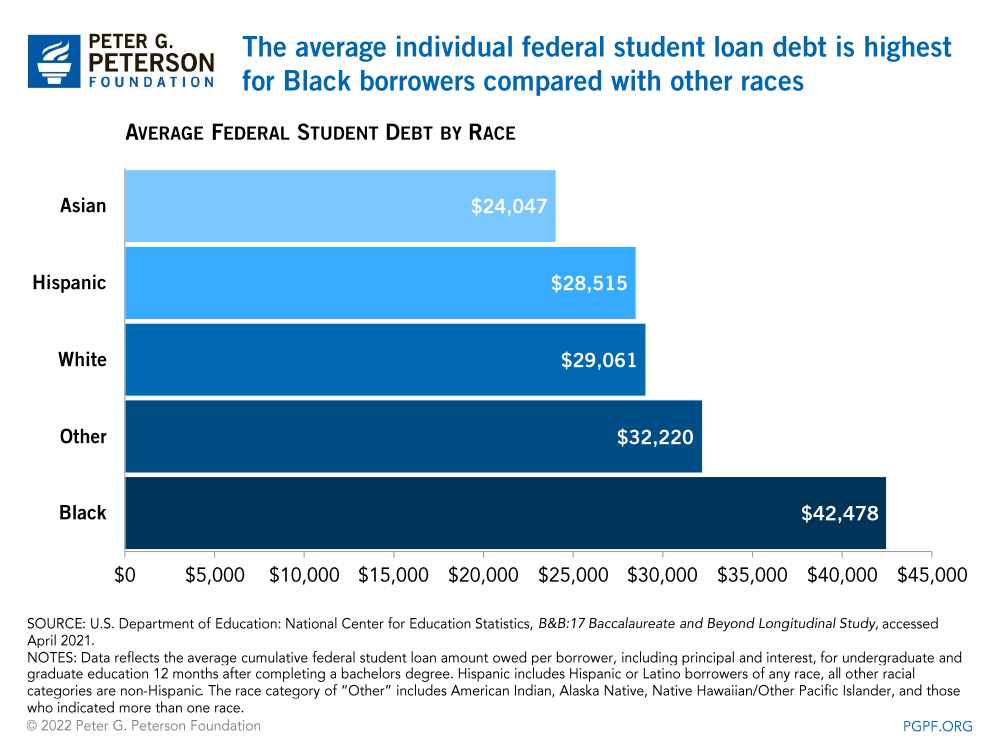

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Taxes On Forgiven Student Loans What To Know Student Loan Hero

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Forgiveness Is Now Tax Free Nextadvisor With Time